IRS Form W-2: Wage and Tax Statement

The IRS Tax Form W-2 Importance for U.S. Taxpayers

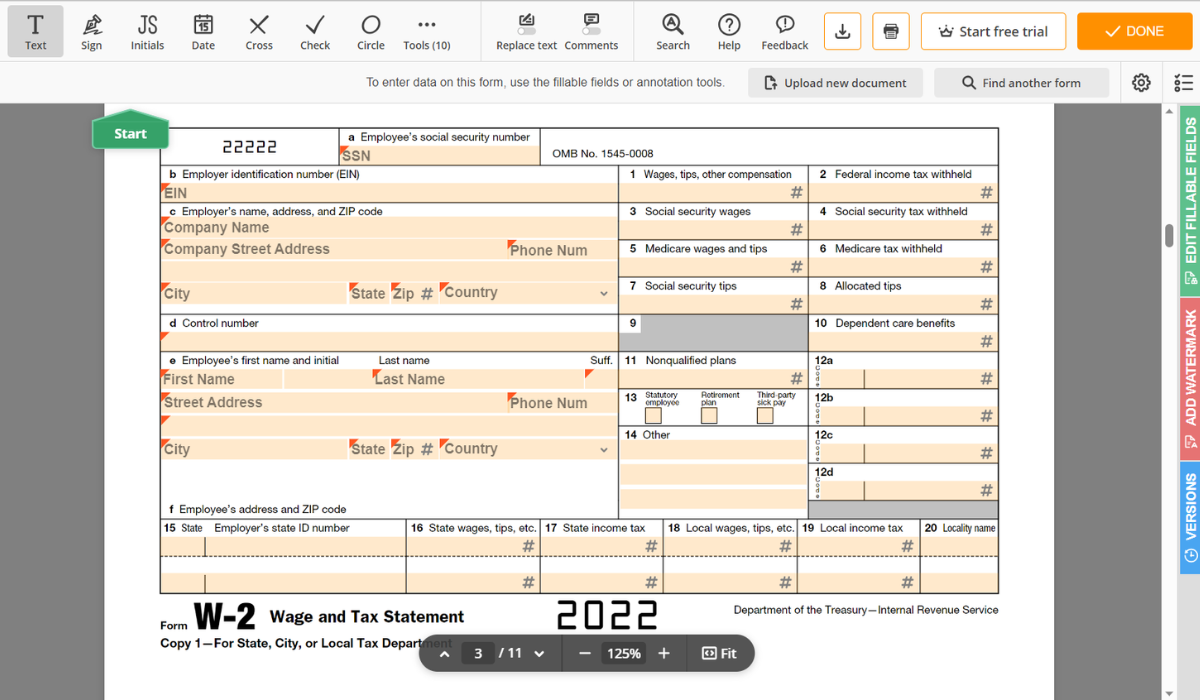

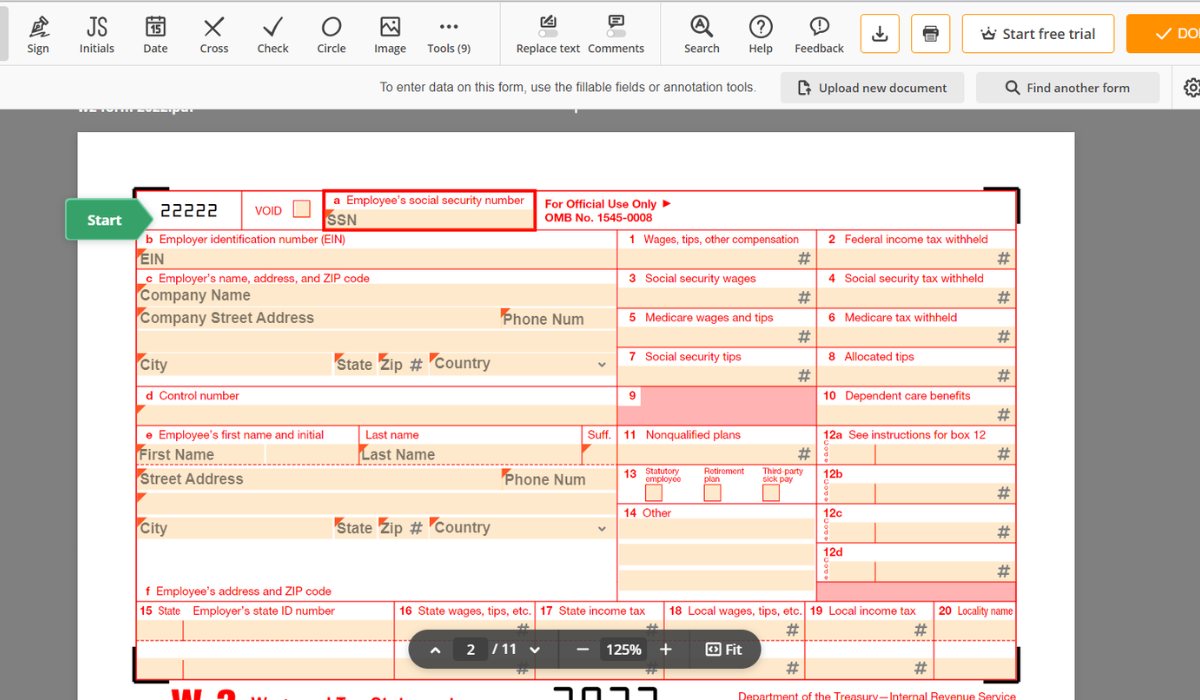

Form W-2 is a crucial document employers in the USA must provide to their employees and the Internal Revenue Service (IRS). In general, the primary purpose of the IRS W2 tax form is to report an employee's annual earnings and the amount of taxes withheld from their salary for the year. Required for federal and state income tax returns, it plays an essential role in taxation, furnishing information that employees must fill out on their 1040 annual forms.

For taxpayers looking to simplify the process of filing their taxes, w2-irsform.com offers invaluable resources. Our site provides the W2 form for 2023 in PDF format, making it readily accessible and easy to fill out. Additionally, w2-irsform.com presents a sample of the W2 form, which is an excellent guide for taxpayers navigating this aspect of tax compliance. The samples are designed with simplicity and clarity, explaining nuances of the template clearly to alleviate any confusion. w2-irsform.com, therefore, functions as a bridge, making the intimidating tax filing task more straightforward and more understandable for everyone.

Income Tax W2 Form Assignments

In the United States, the employer must file a W-2 form when they pay annual wages, salary, or other compensation to an employee and withhold income, social security, or Medicare tax from that payment. Thus, every person who falls under this category must possess a copy of the W-2 form for reconciliation with their income tax return.

The W-2 Form Usage Example

To illustrate, let's consider a fictional character, Tom Foster. Tom is a recent graduate working full-time for a startup technology company in Silicon Valley. His annual gross earnings from employment sum up to $69,000 for 2023. Due to these earnings, his company needs to file Form W-2 online - introducing Tom to our conversation. Primarily, Tom's employment and income make him a typical candidate for the IRS W2 form for 2023. The online filing of the W-2 captures comprehensive details about his earned wages and the taxes withheld during the year by his employer. The information filed in this document synchronizes with the data that Tom reports on his income tax return. Accurate tax documentation contributes to a smooth taxation experience, leaving no room for discrepancies or audits. With any difficulty or uncertainties during the procedure, Tom can request another copy of the W-2 form from his employer or directly from the Internal Revenue Service. This accessibility ensures Tom’s tax filing process is less stressful and more manageable.

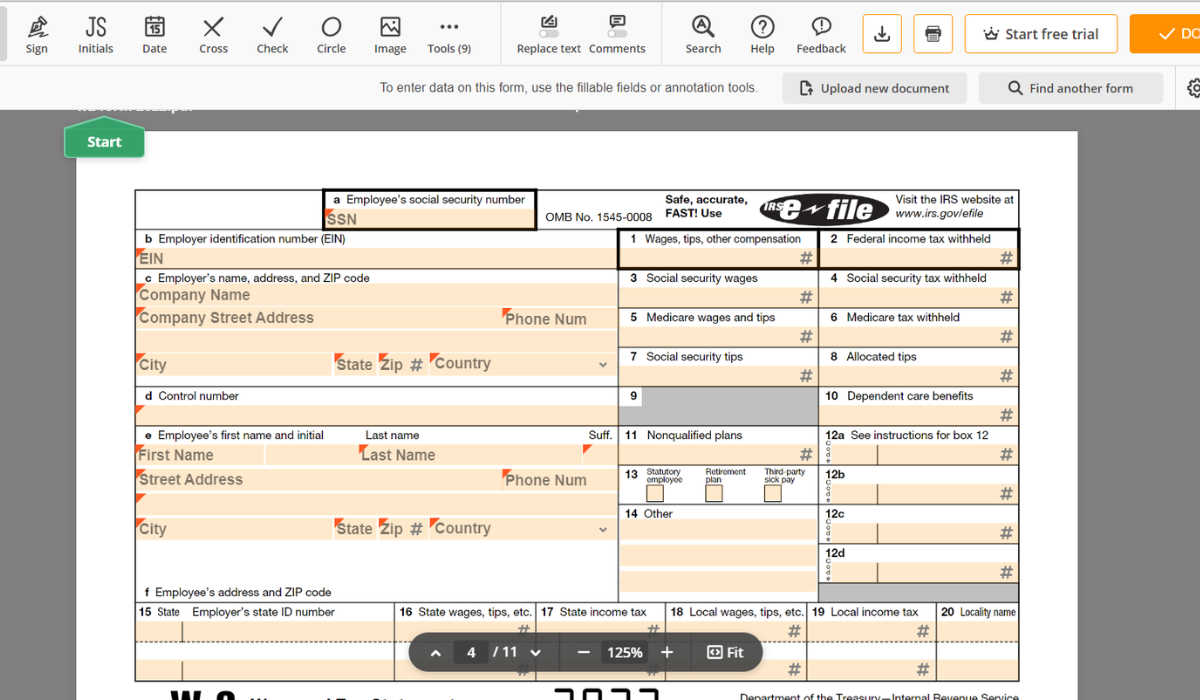

Instructions to Fill Out the W-2 Form

Navigating tax forms like the IRS W-2 form can be daunting, especially for those filing it out for the first time. This guide helps provide easy-to-understand instructions to prevent mistakes and make filling out your W-2 statement far less overwhelming.

Filing the W2 Form to the IRS

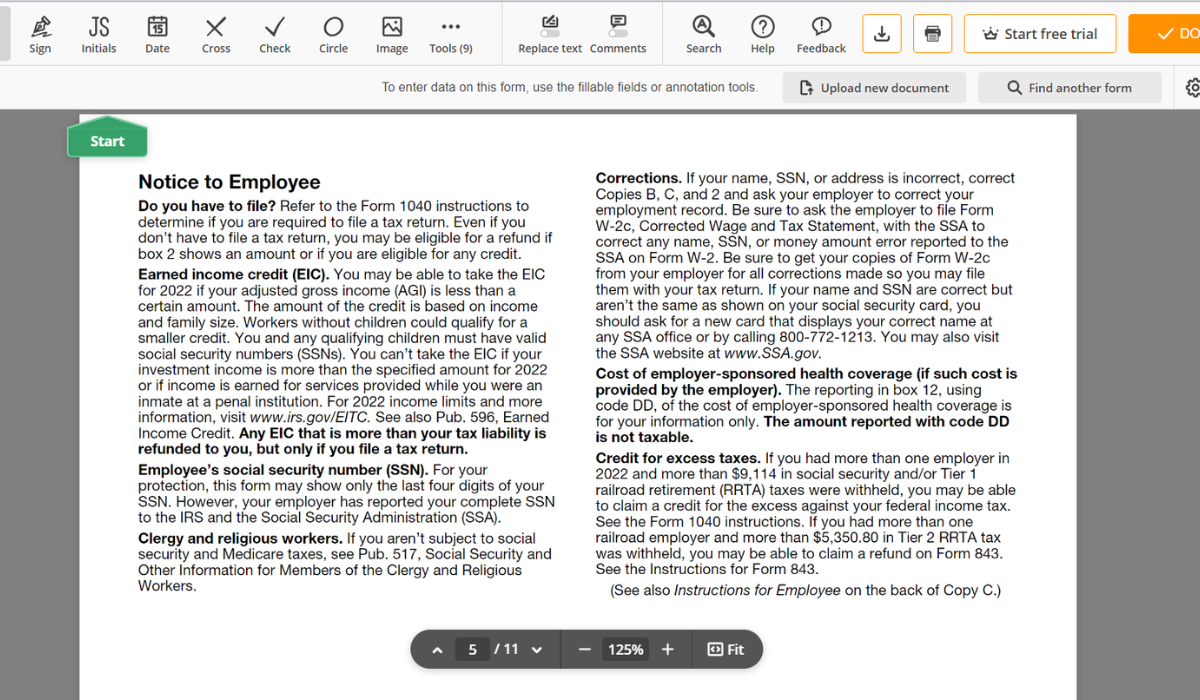

The deadline to file the IRS Form W-2: Wage and Tax Statement in the United States is typically January 31. Don't miss that date because failing to file your form or submitting it late can lead to penalties. For instance, you can expect to pay anywhere from $50 to $550 per W-2 copy in fines, depending on the delinquency period. Follow this link to find out more about the ways to file the W-2.

IRS Penalization System

Furthermore, if you're caught knowingly providing false information, you might be hit with criminal charges such as fraud and tax evasion. Take the time to fill out your IRS printable W2 form for 2023 correctly, ensuring you meet the deadline. Being careful can save you a lot of difficulties down the line.

IRS W-2 Tax Form: Questions From Employees

Federal W2 Form for 2023: Instructions & Examples

Please Note

This website (w2-irsform.com) is an independent platform dedicated to providing information and resources specifically about federal tax form W-2, and it is not associated with the official creators, developers, or representatives of the form or its related services.